On a New Business Model for Artists’ Multiples

The business model for creating, selling and buying artist’s multiples / editions is a throw-back to the industrial age and misses the opportunities of our time.

I have been in the position of artist, edition publisher, edition collector and gallery owner and have always found the model for buying and selling fine art multiples unsatisfactory from all sides.

For the artist it often takes a long time to earn any significant revenue and for the publisher / gallery who has to shoulder the costs of the production process it is heavily cash flow negative. Setting prices is notoriously difficult and from the fear of protecting artist prices and retaining long-term value in the edition, prints often sell far more slowly than they could and end up stockpiled and consequently never release their real value.

For the collector it can be both opaque financially and contradictory in artistic terms. As a collector you are attracted to items that tell stories and the buying of the item often forms an important part of that story. The process of attaching your experiences to an art object while you are its custodian is part of what makes collecting intoxicating.

The chase, the deal, the exciting circumstances around the acquisition are often missing from the purchase of new editions as opposed to older, long sold-out sets. The duplicate nature of editions and their ready availability can make it difficult to get collectors excited about new launches.

So the business of creating and selling new editions brings with it a set of challenging business issues:

- How large to make the edition.

- What price to set each item at.

- When to increase the price following initial sales.

- Whether to drop the price following initial sluggish sales.

- How to communicate price increases and drops to owners of the artist’s editions.

- How to maximise the potential value of each edition for publisher and artist.

- How to generate demand on launch.

- How to reward collector loyalty.

These 8 issues represent the current business model’s challenges and have at their heart the problems of uniqueness and scarcity. Unlike an original work which is by its nature singular, editions are exactly the same and therefore have a relative value to each other as well as the artist’s other work. This can make for a destructive financial relationship if the initial selling is handled badly, particularly as the gallery soon loses resale control of multiples in the open secondary market.

The rule for pricing an edition used to be – take the price of a good original piece by the artist and then divide it by the edition size and this will give you a retail price for the edition launch – this will also help inform the optimum edition size. The benchmark for moving the edition price up or down can then be pegged to the market price for the original pieces.

Definitely logical, but it only solves a number of the issues and doesn’t take advantage of the interconnectedness of our digital society and the emerging ideas of markets based on pricing transparency. In our age of the singular and the customised, where pro-sumption and data drives much smarter decision making, the selling of multiples reflects historical market practices and may be ripe for a reboot.

The Art market has struggled for a way to drive demand and sales online and has largely failed. This is because none of the business models reflect the new economy. Old art market business models don’t travel well to the online world. However if the art editions market were to adopt a digital business model, then it would stand a much better chance of leveraging the power of online access and interest.

My suggestion is to use a new ‘Step Model’ based on data and inject back into the multiple the two things that are missing – scarcity and uniqueness.

The Step Model works as follows:

- Use the existing framework to calculate an initial edition total value.

- Add the likely 5 year uplift percentage of the artist’s price trajectory.

- Apply a calculation to that total value that breaks down edition size into incremental steps, starting lower and peaking with the last item.

- Publish the price steps for each item in the edition as part of the marketing material (so making each unique).

- Create a small number of artist’s and printer’s proofs.

- Pre-sell the edition.

- Use a first-come, first-served basis to reward the collector and early supporter of artist and gallery.

- Use pre-sale revenue to support the cashflow of making the edition.

The purpose of this model is to realise the value of the edition as quickly as possible and enable artists to work with multiples in a commercially viable way. The inclusion of the small number of artist’s and printer’s (maker’s) proofs aside from the numbered step–priced edition may be used to either hold and realise later value or enable the publisher / gallery scope to trade un-restricted with a small number of favoured collectors or museums.

While nothing will stop an item being publicly sold (at auction say) for less than the current step value, it will affect each collector differently and consequently any loss for a collector will be down to their inability to get in early enough rather than their inability to drive a hard bargain with the gallery over pricing – like stocks. Even the last print in the edition will be valuable if the next edition is priced with a higher start and finish than the previous one. By looking at each individual sale as an affirmation of increased value, the model is self-validating.

An additional benefit is that new collectors can get in to the buying of artists’ work more cost effectively and have their support / taste / bravery / vision rewarded.

The model would suit a software platform play where editions could be accessed, bought and sold and the data provided by the platform to give buyers confidence in their purchases.

With the Step Model, the number on the edition will mean more than just a series number. It is a point of scarcity and a testament to the buyer’s involvement. Each number has a story and set of associations inside it. It involves the collector in a new and interesting way that plays to the human nature of collecting. Each multiple is uniquely scarce and physically unique. Each will mean something different. In the absence of the artist building uniqueness into each object, the business model may still bestow it.

Walter Benjamin – “Ownership is the most intimate relationship one can have to objects. Not that they come alive in him; it is he who comes alive in them.”

If you have tried something similar to the Step Model or any editions models that have worked or failed please let me know.

Photo credits:

Yayoi Kusama, Buried in a Flower Garden 2011 – copyright the artist

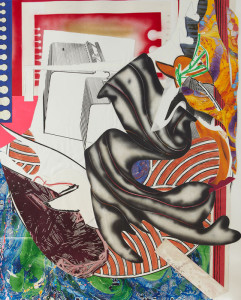

Moby Dick, The Waves 1988, copyright Frank Stella and Tyler Graphics